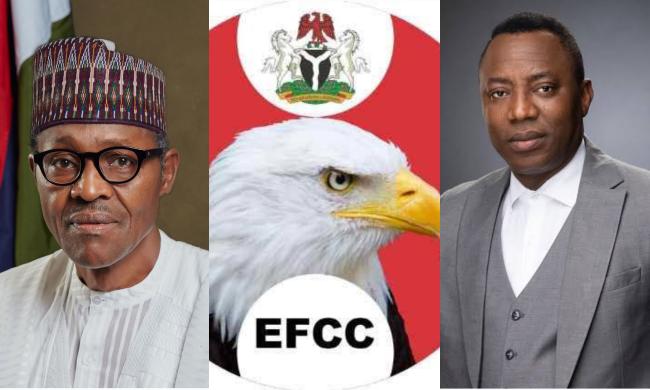

Human rights activist and leader of the #RevolutionNow Movement, Omoyele Sowore, has raised concerns over the delayed prosecution of former President Muhammadu Buhari, his wife Aisha, and other top officials under his administration. Sowore, also a former presidential candidate for the African Action Congress (AAC) in the 2023 elections, took to his verified social media accounts to question the Economic and Financial Crimes Commission (EFCC) about its failure to arrest and prosecute these individuals despite allegations of massive corruption and mismanagement of public funds during the last government.

In a post on Tuesday, Sowore accused Buhari of not only being “Munafikan Banza” (a deceitful person) but also a “Barawo Banza” (a thief). He called for immediate action by the EFCC, demanding the prosecution of Buhari, former First Lady Aisha Buhari, former Attorney General and Minister of Justice, Abubakar Malami, and Buhari’s former personal secretary, Tunde Sabiu. Sowore described their actions as a “monumental theft” of the nation’s resources.

Sowore’s post reads, “Buhari was not just Munafikan Banza, he was also Barawo Banza! Please @officialEFCC when are you charging Former president Muhammadu Buhari, his former personal secretary Tunde Sabiu, former AGF Abubakar Malami, and former First Lady Aisha Buhari for the monumental theft they carried out during their tenure?”

The call for accountability follows a recent report from the Office of the Auditor-General of the Federation (OAuGF), which exposed serious tax irregularities amounting to N14.33 billion across more than 30 Ministries, Departments, and Agencies (MDAs) under Buhari’s administration. This report, part of the Auditor-General’s Annual Review of Non-Compliance and Internal Control Weaknesses, revealed significant lapses in tax deductions, remittances, and financial regulations between 2020 and 2021.

The audit uncovered that six MDAs were responsible for a N129.34 million under-deduction of taxes, a breach of Paragraphs 234 and 235 of the Financial Regulations (2009). These regulations require accounting officers to ensure timely deductions and remittances of applicable taxes, such as Value Added Tax (VAT) and Withholding Tax, to the Federal Inland Revenue Service (FIRS). However, the report highlighted widespread violations of these financial requirements during the last administration.

For updates, join our WhatsApp channel: https://whatsapp.com/channel/0029VabITrvEAKW7DSkTfP0JSowore.