Investor Sentiment Wanes as Nigerian Reforms Hit Roadblocks

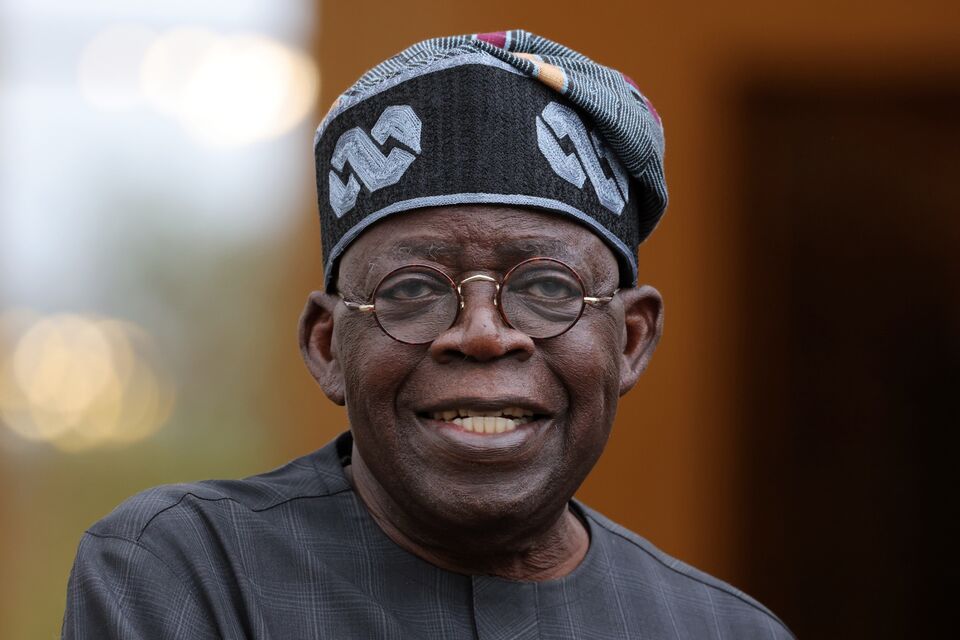

One year after President Bola Tinubu took office, the initial investor excitement over his promised reforms has diminished. Market participants now await further stabilization of Nigeria’s currency and additional policy changes before reconsidering their positions.

Kevin Daly, a portfolio manager at London-based Abrdn Investments Ltd., highlighted the cautious stance of investors. “We are likely to add to local currency bonds once FX volatility declines, but the timing of that remains up in the air,” Daly remarked. He emphasized that for significant investment to return, it would require a mix of increased foreign portfolio flows and a strategic move away from dollar dependency. “It will require a combination of factors such as further foreign portfolio flows, and more importantly some de-dollarization as the central bank can’t be the sole provider of FX liquidity for the market,” he added.

The hesitation reflects broader concerns about Nigeria’s economic stability and the effectiveness of Tinubu’s reforms. Investors are closely watching for concrete steps that could instill confidence, including measures to stabilize the naira and enhance market liquidity. As Nigeria navigates these economic challenges, the actions taken in the coming months will be crucial in determining the future trajectory of foreign investments in the country.