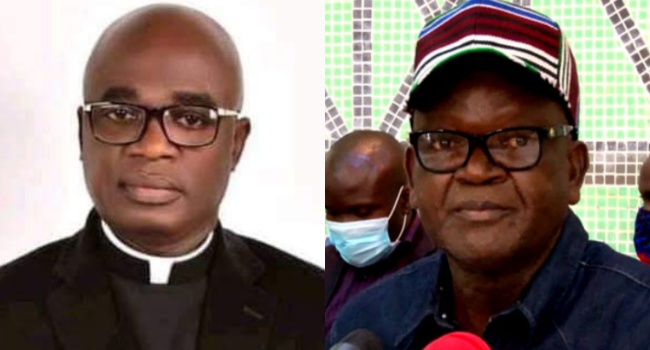

In a recent exchange of words, the former governor of Benue State, Samuel Ortom, has taken issue with his successor, Governor Hyacinth Alia, over allegations regarding the state’s debt profile. Ortom, who served as the state’s immediate-past governor, refuted claims that he left a debt profile of N359 billion for Governor Alia to contend with, calling these allegations false.

Governor Alia had made these assertions during an event in Abuja over the weekend, stating that Ortom’s administration had bequeathed a staggering debt of N359 billion. He further highlighted that some local government employees were owed up to five years’ worth of salary arrears, with the shortest being a four-month delay.

In response, Samuel Ortom, through his media aide, Terver Akase, accused Governor Alia of disseminating misinformation and attempting to deceive the people. Ortom declared that the debt narrative being promoted by the present administration was both false and a deliberate ploy to mislead the citizens.

Remarkably, he pointed out the inconsistency in Governor Alia’s statements, highlighting that in June of the same year, the state government, through the Chief Press Secretary, stated that Ortom had handed over a debt of N187.56 billion, the exact amount the former governor had mentioned during the transition of power.

Ortom underscored the proactive measures his administration had taken to address the state’s debt situation. During his tenure, negotiations and debt reduction efforts had led to a significant debt swap between Benue State and the Federal Government, with the Nigerian Governors’ Forum facilitating the process. The result was a total debt swap of N71.6 billion for both state and local government councils.

The former governor also shared insights into the anticipated inflows that Benue State was poised to receive upon his exit, including a backlog of accumulated Stamp Duties amounting to N48 billion and a refund from the Debt Swap with the Federal Government of N22.95 billion, totaling N70.95 billion. When accounting for these negotiated debt swaps and anticipated inflows, the state’s debt profile was projected to decrease significantly to N45.2 billion.

Furthermore, Ortom highlighted that, thanks to the administration’s efforts, Benue State had pending approvals from the Federal Government, including the balance of a N41 billion bailout and a N20 billion Central Bank of Nigeria facility. Additionally, the state was expecting a N9 billion refund related to subsidy and SURE-P withdrawals.

These revelations by Ortom underscore the complex financial dynamics that have evolved in Benue State, raising questions about the accuracy of debt claims and the handling of state finances by successive administrations. The ongoing dispute highlights the need for transparency and clarity in financial matters to ensure the best interests of the state and its citizens.